August 13, 2025

Understanding Solana: A High-Performance Blockchain

The Important Bits

Solana is a high-speed, low-cost Layer 1 blockchain designed for decentralized applications, DeFi, and NFTs.

It uses a hybrid Proof of History (PoH) and Proof of Stake (PoS) consensus mechanism to enhance scalability and efficiency.

Solana supports various use cases, including DeFi, payments, NFTs, and gaming, making it a strong competitor to Ethereum.

Getting started with Solana involves setting up a compatible wallet, acquiring SOL, and connecting to blockchain applications.

The BitPay Wallet supports building, managing, and utilizing Solana portfolios, all with self-custody control. Read our guide to using Solana with BitPay.

Intro to Solana

Solana is a blockchain designed for building scalable crypto apps. It was built for performance: the ability to handle many transactions with speed and scalability in mind.

Solana’s transaction throughput is nearly unparalleled among Layer 1 blockchains. It can theoretically handle up to 65,000 transactions per second (TPS). In practice, the network typically processes 2,000–4,000 TPS due to factors like validator hardware, network congestion, and ongoing software optimizations.

Solana is a strong competitor to Ethereum. Both platforms provide smart contract functionality, but Solana achieves it at much higher speeds and for a fraction of the cost.

What is Solana?

Solana is a Layer 1 blockchain designed for high-performance decentralized applications (dApps), decentralized finance (DeFi), and non-fungible tokens (NFTs). Built for speed and scalability, it has become one of the most popular blockchain ecosystems for developers and users. Decentralized exchanges, NFT marketplaces, memecoin creation platforms, and various Web3 projects continue to see significant activity on the Solana network.

Unlike Bitcoin’s Proof of Work (PoW) or Ethereum’s Proof of Stake (PoS), the Solana blockchain operates using a hybrid consensus mechanism combining Proof of Stake (PoS) with Proof of History (PoH).

This innovative approach allows Solana to process transactions in parallel, reducing bottlenecks and increasing efficiency. PoH acts as a cryptographic clock that timestamps transactions before they enter the blockchain, enabling faster finalization and lower latency than traditional blockchain networks.

At the heart of the Solana ecosystem is SOL, the network’s native cryptocurrency. SOL plays a crucial role in the blockchain by:

Paying transaction fees for executing smart contracts and transferring assets.

Staking to help secure the network and earn rewards.

Participating in governance decisions as the ecosystem evolves.

By combining cutting-edge technology with low-cost, high-speed transactions, Solana has positioned itself as a major competitor to Ethereum and other smart contract platforms.

How does Solana work?

Thanks to its hybrid Delegated Proof-of-Stake and (DPoS) and Proof-of-History (PoH) consensus mechanism, Solana is one of the fastest, cheapest, and most scalable blockchains on the market today.

While most blockchains rely on timestamps at the time of a transaction for chronological recordkeeping, PoH functions as a verifiable cryptographic clock that timestamps transactions before they are processed.

In most blockchains, nodes or validators must communicate to agree on transaction order, often causing delays and bottlenecks. Solana eliminates this inefficiency by pre-determining transaction sequences using PoH. This process works by generating a historical record of transactions network nodes can easily verify, reducing the need for constant validator coordination.

While PoH is Solana’s standout innovation, it still relies on DPoS for validator selection and finalizing transactions.

Key features of the Solana network

Solana is known for its high performance, low fees, and developer-friendly ecosystem. Its architecture is designed to handle massive transaction volumes without sacrificing speed or decentralization. Here are some of Solana’s defining features:

1. High Throughput

Solana can process thousands of transactions per second (TPS), significantly outperforming Ethereum’s average of 15–30 TPS. This high throughput is made possible by Solana’s Proof of History (PoH) + Proof of Stake (PoS) consensus mechanism, which streamlines transaction ordering and reduces network congestion.

Here’s a transactions per second (TPS) comparison of Solana vs. some other popular blockchains:

Solana: 2,000–4,000 TPS (theoretically up to 65,000 TPS)

Ethereum: ~15–30 TPS (without rollups)

Binance Smart Chain (BSC): ~300 TPS

Bitcoin: ~7 TPS

2. Low Transaction Costs

One of Solana’s biggest advantages is its ultra-low transaction fees, which typically cost less than $0.01. This starkly contrasts with Ethereum, where gas fees can range from a few dollars to over $50 during times of high network congestion.

Here are the average transaction fees of Solana vs. other blockchain networks:

Solana: <$0.01

Ethereum: $1–$50+ (varies based on network demand)

Binance Smart Chain: ~$0.10

Bitcoin: $1–$10+

3. Developer-Friendly Environment

Unlike Ethereum, which primarily uses Solidity for smart contracts, Solana supports Rust and C programming languages. Rust is widely regarded as one of the most efficient and secure programming languages, making it an attractive option for blockchain developers.

4. Scalability Without Layer 2 Solutions

Unlike Ethereum, which relies on Layer 2 solutions like rollups and sidechains to improve scalability, Solana achieves high performance directly on its base layer. This eliminates the complexity of bridging assets between multiple layers, reducing friction for users and developers. It’s worth noting that there are still some developers working on Layer 2’s for Solana to develop decentralized exchanges that can handle the same volume as centralized exchanges.

By combining these features, Solana positions itself as a high-speed, cost-effective alternative to Ethereum, making it a top choice for DeFi applications, NFT marketplaces, and high-performance Web3 projects.

Use cases and applications of Solana

Solana’s architecture makes it a versatile blockchain for various applications. From decentralized finance (DeFi) to payments and gaming, Solana’s technology enables seamless, high-speed interactions across multiple sectors.

Decentralized Finance (DeFi)

Solana is a growing hub for DeFi applications, providing a scalable infrastructure for decentralized exchanges (DEXs), lending platforms, and yield farming protocols. Its ability to process thousands of transactions per second with minimal fees makes it an attractive alternative to Ethereum, where high gas fees can price out smaller users.

Notable Solana-based DeFi projects include:

Raydium - A leading DEX and automated market maker (AMM) built on Solana.

Marinade - Stake via Marinade’s non‑custodial delegation system and unlock top‑tier APY, instant liquidity, and automated validator selection.

Allbridge Core - A native stablecoin bridging experience, enabling seamless cross-chain swaps between EVM and non-EVM blockchains.

Payments

Solana’s fast finality and low-cost transactions make it a strong contender for peer-to-peer (P2P) payments, remittances, and merchant transactions. Solana enables near-instant transfers at a cost of a fraction of a cent.

Some payment projects using Solana include:

BitPay - The oldest continually operated crypto payments processor, allowing consumers to pay merchants, buy gift cards, and pay bills with SOL and stablecoins on the Solana network.

Solana Pay – A decentralized payment protocol that allows merchants to accept crypto transactions with minimal fees.

Circle’s USDC on Solana – A stablecoin integration that facilitates seamless cross-border transactions.

NFTs and Gaming

Due to its scalability and low fees, Solana is a popular blockchain for NFT marketplaces and blockchain gaming. This is crucial for industries such as minting, trading, and in-game interactions, which often require a large number of transactions in a short time.

Some key platforms leveraging Solana for NFTs and gaming include:

Magic Eden – A leading NFT marketplace for Solana-based digital collectibles.

SolSea – Another major Solana NFT marketplace, offering on-chain metadata for creators.

Star Atlas – A futuristic metaverse game that utilizes Solana’s blockchain for asset ownership and trading.

With its scalable architecture, Solana continues to attract developers and users across DeFi, payments, and gaming, solidifying its role as a major player in the blockchain ecosystem.

How to get started with Solana

Getting started with Solana is simple and requires just a few steps. Whether you want to use Solana for transactions, DeFi, or NFTs, the following steps will help you get started.

Get a Wallet

To interact with the Solana blockchain, you’ll need a compatible Solana wallet. A wallet allows you to store, send, and receive Solana assets and interact with decentralized applications (dApps).

Some examples of popular Solana wallets include:

BitPay Wallet - A multichain wallet that supports building, managing, and utilizing Solana portfolios, all with self-custody control.

Phantom – A user-friendly web and mobile wallet known for its seamless integration with Solana dApps.

Solflare – A secure and versatile wallet that supports staking and DeFi applications.

Sollet – A web-based wallet designed for advanced users and developers.

Always be sure to download the official wallet software from its creator when using a web wallet. Once you've chosen a wallet, set it up precisely following the provider’s instructions, and ensure you securely backup your recovery phrase.

Buy or Acquire SOL

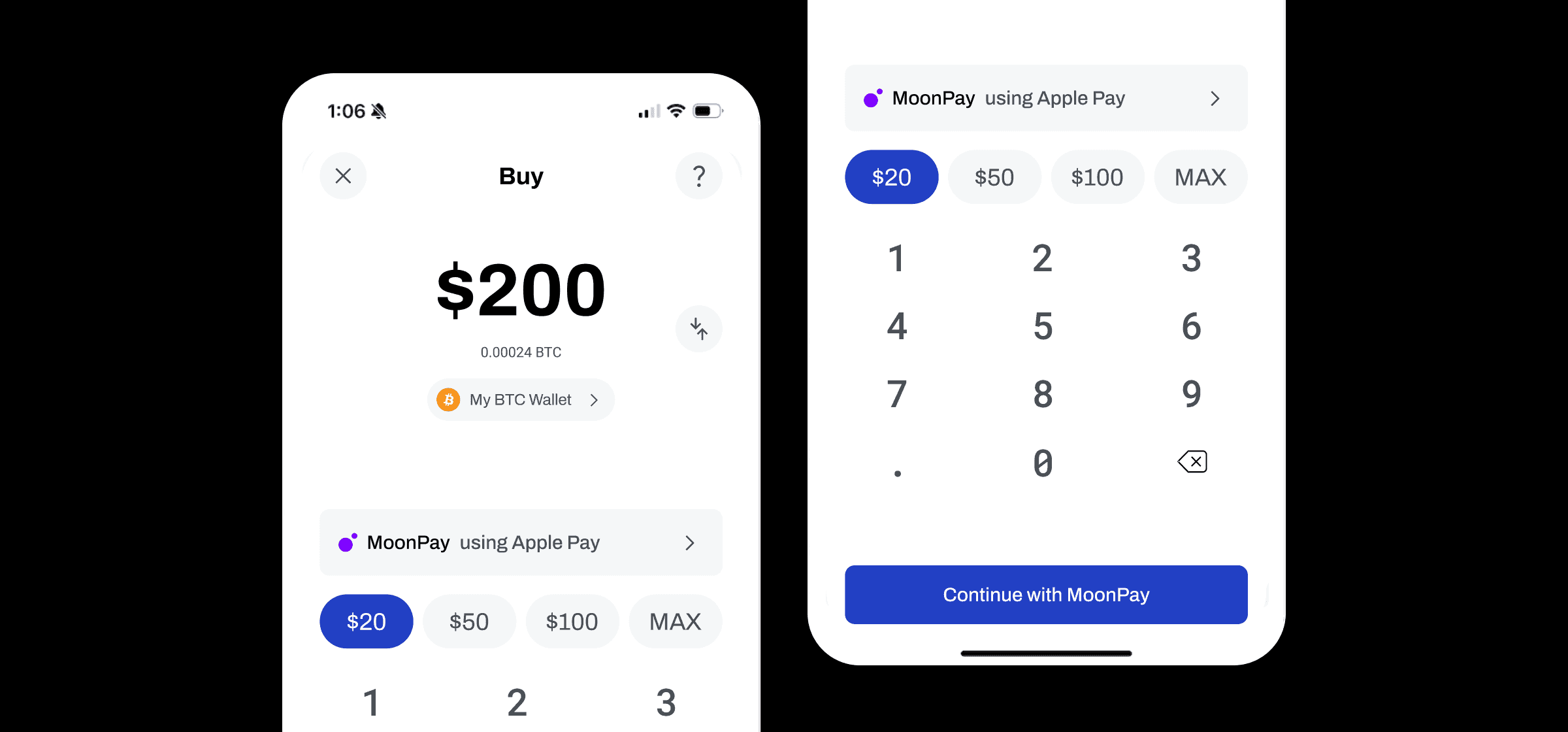

SOL is the native token of the Solana network and is used for transaction fees and staking. SOL and other Solana network tokens can be acquired via the BitPay Wallet app or BitPay website. BitPay partners with trusted platforms like Simplex, MoonPay, Transak, and others to find the most competitive rates on SOL buys.

SOL is also widely available on popular centralized exchanges like Coinbase and Kraken. If acquiring SOL from a centralized exchange, many users choose to transfer it to a Solana-compatible self-custody wallet to ensure full control over their assets.

Connect Your Wallet to Blockchain Platforms

With your wallet funded, you can now explore the Solana ecosystem. Applications typically require you to connect your wallet before interacting with them. Common use cases include:

DeFi platforms – Lend, borrow, swap or stake assets on Solana-powered DeFi applications.

NFT marketplaces – Buy, sell, and trade NFTs on platforms like Magic Eden and Solanart.

Gaming and metaverse projects – Engage in blockchain-based games that use SOL and Solana tokens.

When connecting your wallet, always verify that you are on the official website of a platform to avoid scams.

Looking forward with Solana

Solana is widely considered among the top blockchains for mass adoption of smart contracts and decentralized applications. Few competitors can match its speed and low fees. Anyone who has sent a transaction on Ethereum and then sent one on Solana can attest to this.

The best way to learn what Solana is used for and how it works is to start performing on-chain activities yourself. Set up a self-custodial wallet and deposit some SOL to explore the many available dApps the blockchain supports.

Note: All information herein is for educational purposes only, and shouldn't be interpreted as legal, tax, financial, investment or other advice. BitPay does not guarantee the accuracy, completeness, or usefulness of any information in this publication and we neither endorse, nor are we responsible for, the accuracy or reliability of any information submitted or published by third parties. Nothing contained herein shall constitute a solicitation, recommendation, endorsement or offer to invest, buy, or sell any coins, tokens or other crypto assets. BitPay is not liable for any errors, omissions or inaccuracies. For legal, tax, investment or financial guidance, a professional should be consulted.